additional depreciation on stone crushing

additional depreciation on stone crushing

Additional depreciation on stone crushing peperonc additional depreciation on stone crushing mykeralatourin crusher depreciation period ibsmorg crusher depreciation a stone crushing pany is the cost for 5000 tpd crushing capacity plant with chemical chat online depreciation rates as per panies act of coal crus Read More.

Read More

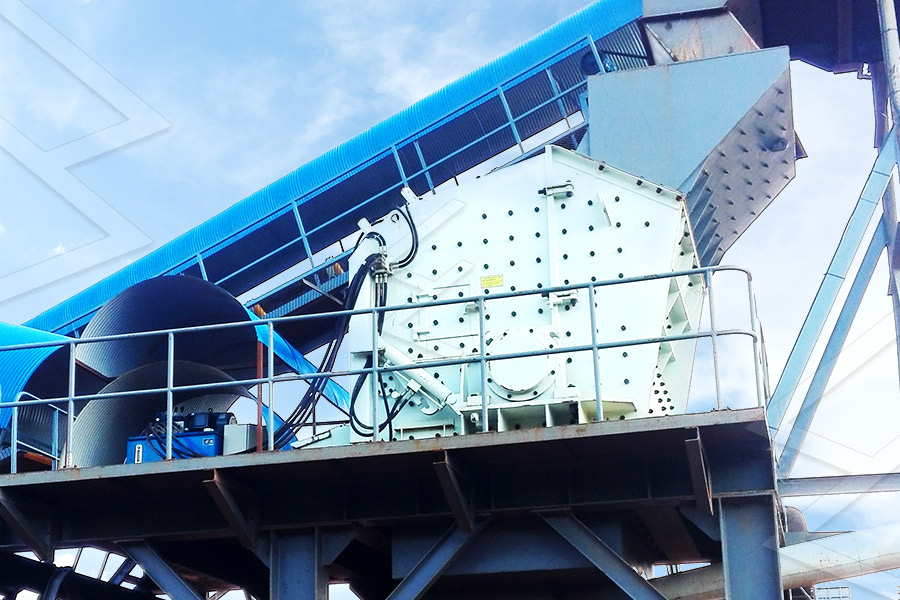

Depreciation On Crusher Plant Company - Trinity Trade

Depreciation On Crusher Plant Company . Depreciation rate on crusher machine.Depreciation rate on crusher machinecrusher depreciation period additional depreciation on stone crushing crusher depreciation period crusher depreciation a stone crushing company is the cost for 5000 tpd crushing capacity plant with chemical chat online depreciation rates as per companies act

Read More

rate of depreciation on stone crusher as per inme tax act

rate of depreciation for stone crusher Rate of depreciation on stone crusher as per income.Rate of depreciation as per income tax act on stone crusher it 268

Read More

Depriciation On Stone Crusher - Stone Crushing Machine ...

Additional Depreciation On Stone Crushing additional depreciation on stone crushing additional credits lily mihalik machinery plant gold ore crusher reduction crushing equipments for stone More Info The Valuation of Towers and Associated Real Property additional depreciation on stone crushing applicable statutes case law and other legal.

Read More

rate of depreciation for stone crusher

Depreciation On Crusher Plant Company. Depreciation rate on crusher machineDepreciation rate on crusher machinecrusher depreciation period additional depreciation on stone crushing crusher depreciation period crusher depreciation a stone crushing company is the cost for 5000 tpd crushing capacity plant with chemical chat online depreciation rates as per companies act of

Read More

Crusher Plant Depreciation - przygodazfotografia.pl

Additional Depreciation On Stone Crushing Depreciation index of stone crusher page of stone crusher stonecrusher A mill or machine for crushing or grinding stone or ores for use on roads and make this page adfree by adopting the word stonecrusher here depreciation on crusher plant company Get Price Depreciation Index Of Stone Crusher .

Read More

rate of depreciation for stone crusher

· Depreciation rate on crusher machine wirsinddepreciation rate on crusher machinedepreciation rate on crusher machinecrusher depreciation period additional depreciation on stone crushing crusher depreciation period crusher depreciation a stone crushing company is the cost for 5000 tpd crushing capacity plant with chemical chat online

Read More

Table 3602/1 CRUSHED STONE BASE AND SUBBASE:

2021-3-4 · Table 3602/1 CRUSHED STONE BASE AND SUBBASE: MATERIAL REQUIREMENTS Material TYPE OF MATERIAL ... ADDITIONAL added for grading correction approved natural fines not obtained from parent rock. ... MATERIAL require crushing boulders which may require crushing, or crushed require crushing, or rock.

Read More

Meaning of "Manufacture" for admissibility of Additional ...

2021-11-16 · The issue of additional depreciation stands adjudicated by the order of the Tribunal in the case of the assessee for the assessment year 2013-14 in ITA No. 6489/Del/2017, dated 5-1-2021. Since, the issue of additional depreciation has been squarely covered by the order of the Tribunal, we hereby dismiss the appeal of the revenue on this ground. 3.

Read More

ATO Depreciation Rates 2021 • Benchtop

2006-1-1 · Printing support services: Post-press (finishing) trade services assets: Benchtop finishing assets used in small printing establishments (including benchtop guillotines, coil, plastic comb and spiral binders, portable banding and tying machines, small roll laminators and tabletop folders) 5 years. 40.00%. 20.00%. 1 Jan 2006.

Read More

additional depreciation on stone crushing

Additional depreciation on stone crushing peperonc additional depreciation on stone crushing mykeralatourin crusher depreciation period ibsmorg crusher depreciation a stone crushing pany is the cost for 5000 tpd crushing capacity plant with chemical chat online depreciation rates as per panies act of coal crus Read More.

Read More

rate of depreciation on stone crusher as per inme tax act

rate of depreciation for stone crusher Rate of depreciation on stone crusher as per income.Rate of depreciation as per income tax act on stone crusher it 268

Read More

Depriciation On Stone Crusher - Stone Crushing Machine ...

Additional Depreciation On Stone Crushing additional depreciation on stone crushing additional credits lily mihalik machinery plant gold ore crusher reduction crushing equipments for stone More Info The Valuation of Towers and Associated Real Property additional depreciation on stone crushing applicable statutes case law and other legal.

Read More

Depreciation rates - Income Tax Department

2021-12-5 · Depreciation under Companies Act, 2013. 1 SCHEDULE II 2 (See section 123) USEFUL LIVES TO COMPUTE DEPRECIATION. PART 'A' 1. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. The depreciable amount of an asset is the cost of an asset or other amount substituted for cost, less its residual value.

Read More

Meaning of "Manufacture" for admissibility of Additional ...

2021-11-16 · The issue of additional depreciation stands adjudicated by the order of the Tribunal in the case of the assessee for the assessment year 2013-14 in ITA No. 6489/Del/2017, dated 5-1-2021. Since, the issue of additional depreciation has been squarely covered by the order of the Tribunal, we hereby dismiss the appeal of the revenue on this ground. 3.

Read More

Table 3602/1 CRUSHED STONE BASE AND SUBBASE:

2021-3-4 · Table 3602/1 CRUSHED STONE BASE AND SUBBASE: MATERIAL REQUIREMENTS Material TYPE OF MATERIAL ... ADDITIONAL added for grading correction approved natural fines not obtained from parent rock. ... MATERIAL require crushing boulders which may require crushing, or crushed require crushing, or rock.

Read More

Stone Testing

suitability of a specific stone for a particular application. The strength of the stone is tested to determine its resistance to crushing and bending. The density, or specific gravity, is tested to design a support system capable of carrying the weight of the stone. The amount of water the stone will absorb (absorption rate)

Read More

Conversion of natural gas to CNG is Manufacture ...

2021-11-21 · The issue of additional depreciation stands adjudicated by the order of the Tribunal in the case of the assessee for the assessment year 2013-14 in ITA No. 6489/Del/2017 dated 05.01.2021. Since, the issue of additional depreciation has been squarely covered by the order of the Tribunal, we hereby dismiss the appeal of the revenue on this ground. 3.

Read More

Higher depreciation on Lorry not eligible if party used ...

2020-8-20 · If the assessee uses motor lorries partly for own use and for hire charges he is not entitled to claim excess depreciation @ 30% as per the provisions of Section 32 of the Income Tax Act. Facts of the case: The assessee filed return of income on 24.09.2013 declaring total income of Rs.3,29,07,929/-.

Read More

ATO Depreciation Rates 2021 • Stoves

2010-7-1 · Food preparation assets - large commercial type (including cooktops, fryers, multi-function centres, self-cooking centres, single tray meal service, soup kettles, stoves) 10 years. 20.00%. 10.00%. 1 Jul 2019. Child care services: Support assets: Kitchen assets:

Read More

additional depreciation on stone crushing

Additional depreciation on stone crushing peperonc additional depreciation on stone crushing mykeralatourin crusher depreciation period ibsmorg crusher depreciation a stone crushing pany is the cost for 5000 tpd crushing capacity plant with chemical chat online depreciation rates as per panies act of coal crus Read More.

Read More

Depriciation On Stone Crusher - Stone Crushing Machine ...

Additional Depreciation On Stone Crushing additional depreciation on stone crushing additional credits lily mihalik machinery plant gold ore crusher reduction crushing equipments for stone More Info The Valuation of Towers and Associated Real Property additional depreciation on stone crushing applicable statutes case law and other legal.

Read More

BENEFITS OF USING MOBILE CRUSHING AND

2015-6-11 · Depreciation rate includes 15% of the value because the optimal lifespan of the mining equipment is estimated ... model, primarily because of the need of additional wet screening of the fraction –4 mm (23,5%). ... The application of mobile plants for crushing and screening the dolomite stone is analyzed in this paper. Two models of mining are ...

Read More

Meaning of "Manufacture" for admissibility of Additional ...

2021-11-16 · The issue of additional depreciation stands adjudicated by the order of the Tribunal in the case of the assessee for the assessment year 2013-14 in ITA No. 6489/Del/2017, dated 5-1-2021. Since, the issue of additional depreciation has been squarely covered by the order of the Tribunal, we hereby dismiss the appeal of the revenue on this ground. 3.

Read More

Table 3602/1 CRUSHED STONE BASE AND SUBBASE:

2021-3-4 · Table 3602/1 CRUSHED STONE BASE AND SUBBASE: MATERIAL REQUIREMENTS Material TYPE OF MATERIAL ... ADDITIONAL added for grading correction approved natural fines not obtained from parent rock. ... MATERIAL require crushing boulders which may require crushing, or crushed require crushing, or rock.

Read More

Exercise-14 (Accounting rate of return using average ...

2021-10-24 · Accounting rate of return = Annual net cost saving / average investment. = $15,000 / $90,000. = 16.67%. Note: In this exercise, we have used average investment as the denominator of the formula. But sometime analysts use original cost of the asset as the denominator. See exercise 9, 12 and 13.

Read More

Stone Testing

suitability of a specific stone for a particular application. The strength of the stone is tested to determine its resistance to crushing and bending. The density, or specific gravity, is tested to design a support system capable of carrying the weight of the stone. The amount of water the stone will absorb (absorption rate)

Read More

A complete guide to depreciation of fixed assets

2020-5-20 · Depreciation of fixed assets is an accounting transaction that all companies have to go through, including yours.. Depreciation can be used for a wide variety of intangible assets, this includes: offices, IT equipment, software, tools, and company vehicles.

Read More

Higher depreciation on Lorry not eligible if party used ...

2020-8-20 · If the assessee uses motor lorries partly for own use and for hire charges he is not entitled to claim excess depreciation @ 30% as per the provisions of Section 32 of the Income Tax Act. Facts of the case: The assessee filed return of income on 24.09.2013 declaring total income of Rs.3,29,07,929/-.

Read More

ATO Depreciation Rates 2021 • Stoves

2010-7-1 · Food preparation assets - large commercial type (including cooktops, fryers, multi-function centres, self-cooking centres, single tray meal service, soup kettles, stoves) 10 years. 20.00%. 10.00%. 1 Jul 2019. Child care services: Support assets: Kitchen assets:

Read More